customer story

Winning in a dominated market

+3000% qualified leads, -90% CAC, +200% MRR

“We were competing against much bigger players and burning money on ads. Now inbound leads are consistent and profitable.”

Steve

Founder, Edgewater Guitars

Edgewater Guitars is a vintage guitar buyer competing against national incumbents that controlled most search demand. By focusing on trust, depth, and asymmetric positioning, the business built a profitable inbound engine without relying on heavy ad spend.

How a Vintage Guitar Buyer Entered a Dominated Market and Built a Profitable Organic Lead Engine

Industry: Vintage Guitar Buying & Resale

Stage at engagement: Established local operator competing against national incumbents

Engagement length: Ongoing (initial inflection in first 90 days)

Role: Fractional Marketing Leadership

THE OUTCOME

From invisible to competitive in a market controlled by incumbents

2 website conversions in the prior year → 20+ qualified leads in the first week

100% organic lead generation during launch window

90% reduction in cost-per-click on paid search

First-page rankings across dozens of high-intent searches

Consistent, profitable months replacing “barely breaking even”

This wasn’t about outspending competitors.

It was about changing the terms of competition.

THE CONTEXT

Steve Pedone ran a legitimate, experience-driven vintage guitar buying business.

He traveled to sellers, authenticated instruments in person, and paid fair prices. The business worked operationally.

But online, Edgewater Guitars was invisible.

The reality he faced:

Two national competitors dominated nearly all organic search traffic

Ads were expensive and barely broke even

His website had generated two customers in an entire year

What he thought the problem was:

“We need a better website.”

What he actually needed was a different market entry strategy.

THE REAL PROBLEM (DIAGNOSIS)

This wasn’t a website problem.

It was a positioning and trust asymmetry problem in a dominated market.

Competing head-to-head on generic “sell your guitar” searches was unwinnable

The incumbents relied on scale, brand familiarity, and ad spend

Edgewater had expertise — but no visible authority or differentiation

The constraint wasn’t traffic access.

It was credibility at the moment of decision.

THE STRATEGIC DECISIONS

Decision 1: Stop competing on breadth

Instead of chasing broad, high-competition keywords, we focused on depth — brand-specific, model-specific, and region-specific searches where intent was high and competition was weaker.

Decision 2: Win trust before winning traffic

In a market where sellers comparison-shop by default, conversion depends on trust — not ranking position alone.

The strategy prioritized:

Education over promotion

Transparency over hype

Human authority over corporate distance

Decision 3: Create assets competitors couldn’t easily replicate

Rather than producing generic content, we built proprietary tools and educational resources that created real utility — becoming link-worthy, reference-worthy assets instead of disposable pages.

Decision 4: Use paid media for efficiency, not dominance

Paid search was rebuilt around high-intent terms and landing-page alignment, not volume or vanity metrics.

THE LEADERSHIP ROLE (WHAT I OWNED)

As fractional marketing leadership, my role was to:

Diagnose the real constraint in a dominated market

Choose an asymmetric strategy competitors couldn’t easily copy

Define success metrics tied to profitability, not traffic alone

Design and validate the system rapidly

Transfer content and production capability back to the business

To validate strategy quickly, I led the initial build. Once traction was proven, production and expansion were progressively handed off.

THE SYSTEM BUILT (OVERVIEW)

Market Entry & Positioning

Clear differentiation around expertise, transparency, and human interaction

Simple, trust-forward selling process

Visible authority replacing anonymity

Organic Growth Engine

Brand- and model-specific SEO architecture

Regional targeting across Midwest markets

Educational content answering real seller questions

Proprietary valuation and serial-number tools driving backlinks and repeat visits

Paid Search Efficiency

Rebuilt campaigns around high-intent, low-competition terms

Tight alignment between ads, landing pages, and seller expectations

Same budget, radically improved ROI

Authority & Trust Layer

Founder-led video content

Reviews and testimonials system

Branded photography reinforcing legitimacy and professionalism

THE RESULTS

Lead generation

Before: 2 website conversions in an entire year

After: 20+ qualified leads in the first week

Ongoing: Consistent inbound flow following organic growth curve

Paid efficiency

CPC: $3.38 → $0.35

CTR: Increased to 6.42%

Cost per lead: ~$16

Budget unchanged at $20/day

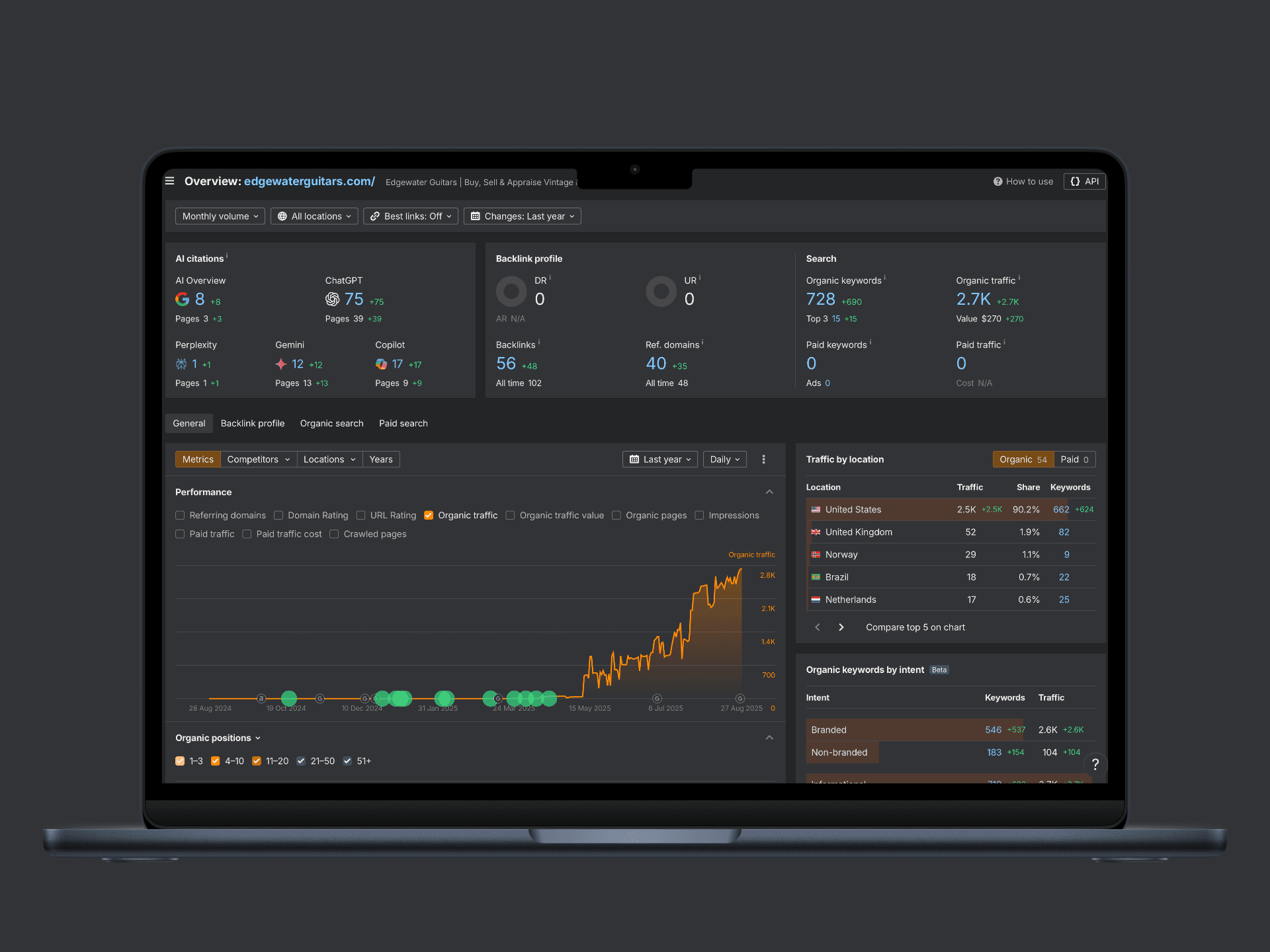

Organic performance

Monthly organic traffic: ~4,800 (from near zero)

Ranking keywords: 450+

First-page rankings for 47+ high-intent searches

National reach with strong regional presence

Business impact

Shift from marginal months to consistent profitability

Reduced dependence on paid acquisition

Clear competitive identity in a previously dominated market

THE SYSTEM DURABILITY

What continues working without constant involvement:

SEO content compounding over time

Proprietary tools driving traffic and backlinks

Internal content production (Steve now produces ~25%)

Efficient paid search structure

Ongoing trust signals converting new visitors

Importantly, the business avoided premature hiring:

No SEO agency

No content team

No paid media firm

Strategy was proven before scale.

THE PATTERN

This engagement followed a repeatable pattern:

Strong business model

Weak visibility

Entrenched competitors controlling obvious channels

The standard playbook fails here:

Outspend incumbents (unsustainable)

Publish generic SEO content (slow, often ineffective)

Accept limited growth (the default outcome)

What worked instead:

Depth over breadth

Utility over noise

Humanity over corporate scale

Efficiency over volume

WHY THIS WORKED

Correct diagnosis: This was a trust problem, not a traffic problem.

Asymmetric strategy: Competitors relied on scale; Edgewater relied on usefulness and expertise.

Fast validation: Strategy was proven before expanding effort.

System transfer: The business now owns the engine, not a consultant.

WHAT THIS REQUIRED

From the founder

Willingness to abandon “compete like the big guys” thinking

Commitment to showing up as the visible expert

Patience to let organic compound while ads covered short-term needs

From leadership

Market and buyer psychology insight

Experience navigating dominated competitive landscapes

Ability to design systems that scale without increasing complexity

The takeaway

Edgewater didn’t win by being louder.

They won by being more useful, more human, and more trustworthy — in a market where incumbents relied on scale and anonymity.

When competitors control the obvious channels, growth doesn’t come from trying harder.

It comes from choosing a strategy they can’t easily replicate.

Another Success Story